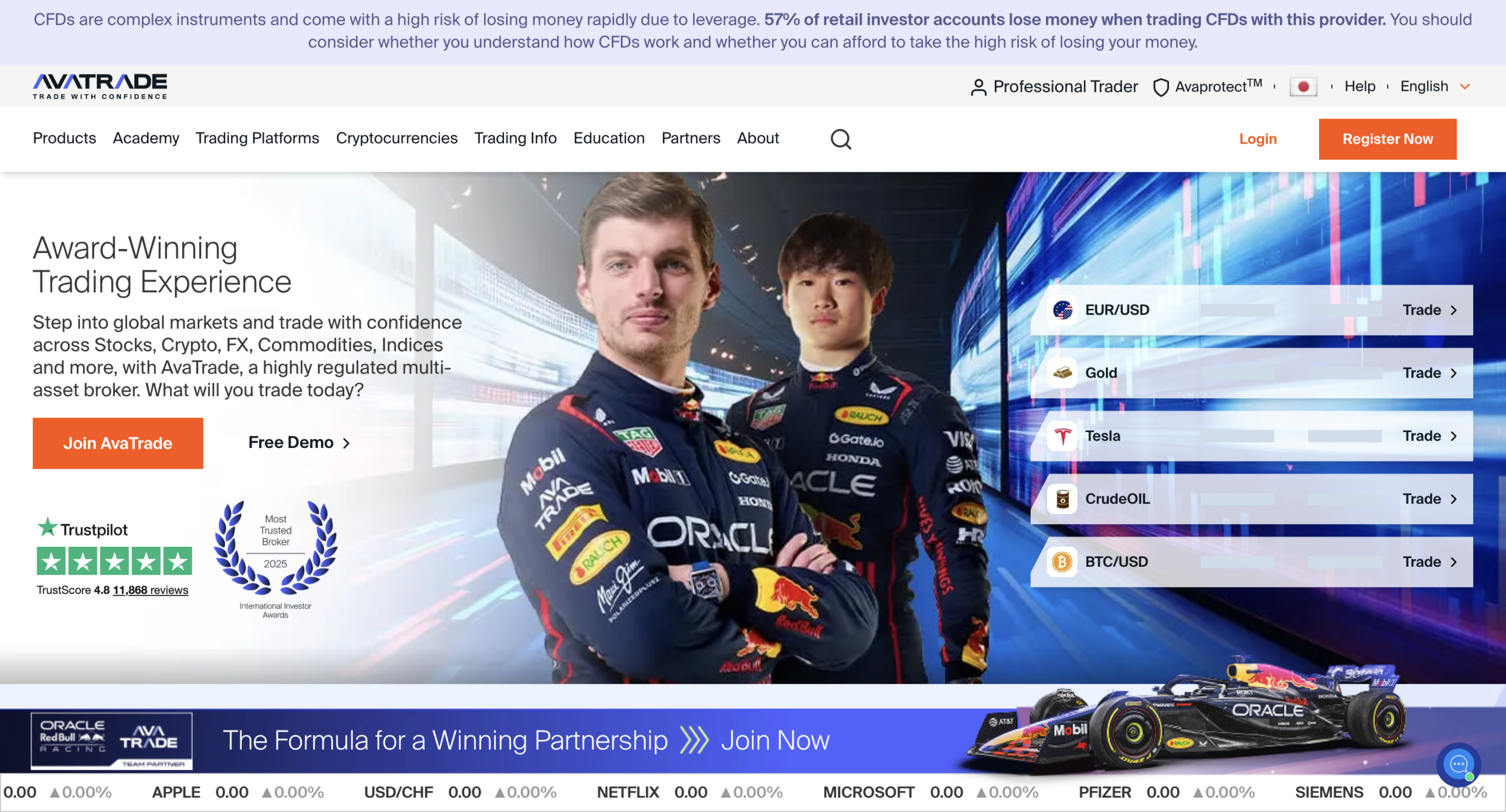

AvaTrade is a globally recognized online trading broker that offers a wide range of financial instruments and multiple trading platforms. Founded in 2006, AvaTrade has built a strong reputation for regulatory compliance, innovative technology, and a commitment to trader education. The company serves clients in over 150 countries.

Company Profile

Establishment: AvaTrade was founded in 2006 in Dublin, Ireland, originally under the name AvaFX. The company rebranded to AvaTrade in 2013 and has since become one of the most trusted names in online trading.

Regulation: AvaTrade is one of the most heavily regulated brokers in the industry, holding licenses from the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), the Financial Services Agency (FSA) of Japan, the Financial Sector Conduct Authority (FSCA) of South Africa, the Abu Dhabi Global Markets (ADGM), and the British Virgin Islands Financial Services Commission (BVI FSC), among others. This extensive regulatory coverage provides traders with exceptional security and trust.

Trading Products

Forex: AvaTrade offers a wide selection of currency pairs, including over 50 major, minor, and exotic pairs, providing comprehensive access to the forex market.

Commodities: The platform provides trading opportunities in popular commodities, including gold, silver, crude oil, natural gas, and agricultural products like coffee and sugar.

Indices: Traders can access major global indices, including the S&P 500, NASDAQ, FTSE 100, DAX 30, and Nikkei 225.

Shares: AvaTrade offers CFD trading on shares from major global companies listed on leading stock exchanges.

Cryptocurrencies: The platform supports trading on popular cryptocurrencies, including Bitcoin, Ethereum, Ripple, Litecoin, and Dash.

Bonds: AvaTrade also offers trading on government bonds, including US Treasury bonds, European bonds, and Japanese bonds.

ETFs: Traders can access a range of Exchange-Traded Funds covering various sectors and regions.

Trading Platform

MetaTrader 4 (MT4): AvaTrade offers the MetaTrader 4 platform with its comprehensive suite of charting tools, technical indicators, and support for automated trading through Expert Advisors (EAs).

MetaTrader 5 (MT5): AvaTrade also supports MetaTrader 5, providing additional features and enhanced functionality for advanced traders.

AvaTradeGO: AvaTrade’s proprietary mobile app, AvaTradeGO, offers an intuitive trading experience with advanced features including AvaProtect (a risk management tool), social trading integration, and real-time market data.

AvaOptions: AvaTrade is one of the few retail brokers to offer a dedicated options trading platform, allowing traders to trade vanilla options on forex pairs.

AvaSocial: AvaTrade provides a social trading app that allows users to follow and copy experienced traders, similar to other social trading platforms.

Key Features

Variety of Account Types: AvaTrade offers retail and professional account types, with conditions varying based on the trader’s classification and regulatory jurisdiction.

Leverage: AvaTrade offers leverage up to 1:400 on certain instruments (varying by regulation), providing traders with the ability to amplify their market exposure.

AvaProtect: A unique risk management feature that allows traders to protect their trades against losses for a specified time period, in exchange for a small fee. This innovative tool provides a form of insurance for individual trades.

Automated Trading: AvaTrade supports various automated trading solutions, including DupliTrade and ZuluTrade integration, in addition to MT4 and MT5 Expert Advisors.

Islamic Accounts: AvaTrade offers swap-free Islamic accounts for traders who require Sharia-compliant trading conditions.

Education and Support

Educational Resources: AvaTrade provides a comprehensive education center, including video tutorials, e-books, articles, webinars, and an economic calendar. The educational content covers topics from beginner basics to advanced trading strategies.

Customer Support: AvaTrade offers multilingual customer support 24/5 via live chat, email, and phone. The support team is known for its professionalism and responsiveness.

Trading Terms

Spreads and Commissions: AvaTrade offers competitive fixed and variable spreads depending on the account type and instrument. Spreads on major forex pairs start from 0.9 pips. Most account types are commission-free, with the cost of trading built into the spread.

Deposit and Withdrawal Options: AvaTrade supports various payment methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. The platform does not charge deposit fees.

Minimum Deposit: AvaTrade requires a minimum deposit of $100 to open a trading account.

Risk Management

Stop-Loss Orders: AvaTrade provides standard risk management tools, including stop-loss, take-profit, and trailing stop orders.

Negative Balance Protection: AvaTrade offers negative balance protection, ensuring that traders cannot lose more than their deposited funds.

AvaProtect: The unique AvaProtect feature provides an additional layer of risk management by allowing traders to hedge individual trades against losses.

Pros

- Extensive Regulation: One of the most heavily regulated brokers globally, providing exceptional trust and security.

- Multiple Platforms: Access to MT4, MT5, AvaTradeGO, AvaOptions, and social trading platforms offers flexibility for all types of traders.

- AvaProtect: The innovative trade protection feature is a unique risk management tool not commonly found with other brokers.

- Options Trading: The AvaOptions platform allows retail traders to access vanilla options, which is rare among online brokers.

- Comprehensive Education: Robust educational resources make AvaTrade suitable for beginners.

Cons

- Inactivity Fee: AvaTrade charges an inactivity fee of $50 per quarter after three months of no trading activity, and an administration fee of $100 after 12 months.

- No ECN Account: AvaTrade does not offer ECN or raw spread accounts, which may not appeal to scalpers or high-frequency traders.

- Fixed Spreads May Be Wider: While fixed spreads provide predictability, they may be wider than variable spreads offered by competing brokers during normal market conditions.

Conclusion

AvaTrade is a well-established and highly regulated broker that offers a diverse range of trading instruments and platforms. Its unique features like AvaProtect and AvaOptions set it apart from competitors, while its comprehensive educational resources make it an excellent choice for traders of all levels. However, traders should be aware of the inactivity fees and the absence of ECN accounts. Understanding the risks involved in trading and utilizing the available risk management tools is always essential.

Comments