eToro is a pioneering social trading and multi-asset brokerage platform that has revolutionized the way people invest and trade. Founded in 2007, eToro is best known for its innovative CopyTrading feature, which allows users to automatically replicate the trades of successful investors. The platform serves over 30 million registered users in more than 140 countries.

Company Profile

Establishment: eToro was founded in 2007 in Tel Aviv, Israel. Originally launched as RetailFX, the company rebranded to eToro in 2010 and has since become one of the most recognizable names in online trading and investing.

Regulation: eToro is regulated by several top-tier financial authorities, including the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Securities and Exchange Commission (SEC) in the United States. This extensive regulatory coverage ensures a high level of investor protection.

Trading Products

Forex: eToro offers a wide selection of currency pairs, including major, minor, and exotic pairs, enabling traders to participate in the global forex market.

Stocks: Unlike many CFD-only brokers, eToro allows users to buy and hold real stocks with zero commission. Traders can invest in thousands of stocks from major exchanges worldwide.

Cryptocurrencies: eToro offers one of the most extensive cryptocurrency selections among mainstream brokers, with dozens of crypto assets available for trading and investing, including Bitcoin, Ethereum, Cardano, Solana, and more.

Commodities: The platform provides access to commodities including gold, silver, oil, natural gas, and agricultural products.

Indices: Traders can access major global indices such as the S&P 500, NASDAQ, FTSE 100, and DAX.

ETFs: eToro offers a wide range of Exchange-Traded Funds (ETFs), allowing traders to invest in diversified portfolios with a single trade.

Trading Platform

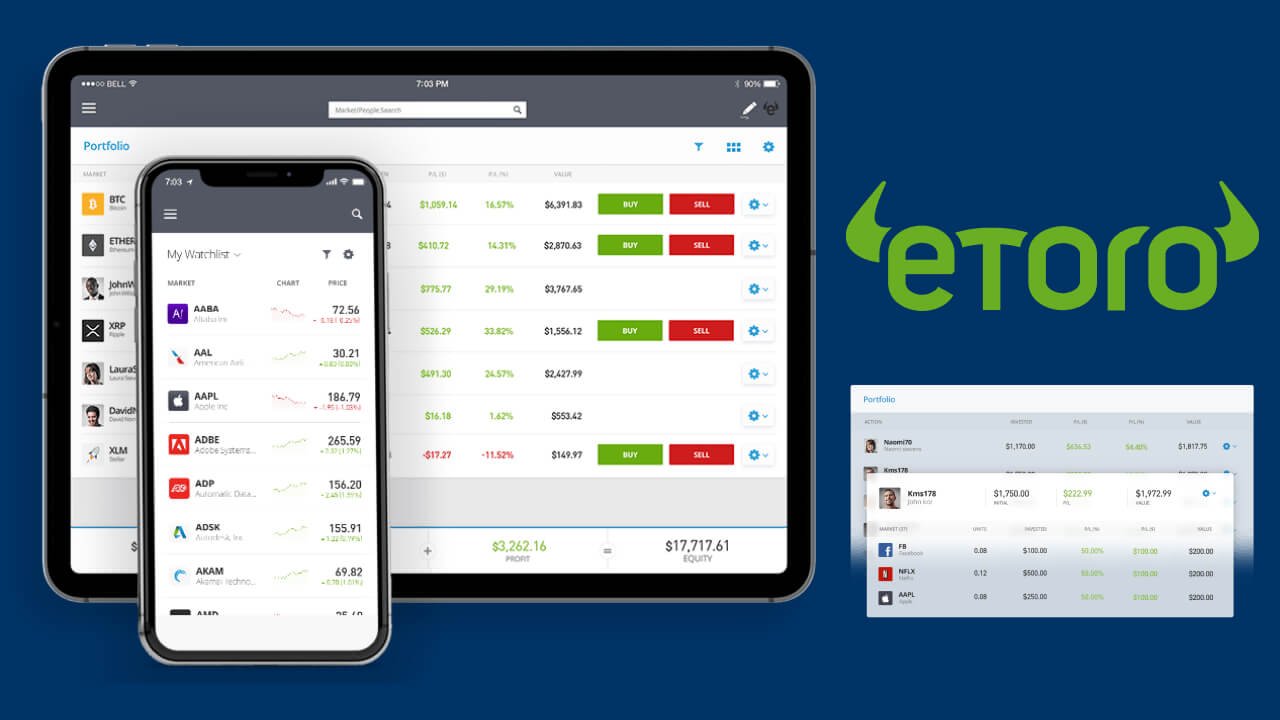

eToro Platform: Unlike many brokers that rely on MetaTrader, eToro uses its own proprietary platform. The eToro platform is designed with a social media-like interface that makes trading intuitive and engaging. It includes advanced charting tools, a news feed, and social features.

eToro Mobile App: The eToro mobile app provides a seamless trading experience on both iOS and Android devices, with full access to all platform features, including CopyTrading and portfolio management.

eToro Money: eToro also offers a digital wallet and payment app that allows users to manage their crypto assets and make payments.

Key Features

CopyTrading: eToro’s flagship feature allows users to automatically copy the trades of top-performing investors. Users can browse trader profiles, review their performance history, risk scores, and strategies before choosing to copy them.

Smart Portfolios: eToro offers Smart Portfolios (formerly CopyPortfolios), which are professionally managed investment strategies that bundle together multiple assets or top traders into a single portfolio.

Social Trading: eToro’s social features allow traders to interact, share ideas, and discuss market trends. The platform’s news feed functions similarly to a social media timeline, creating a community-driven trading experience.

Commission-Free Stock Trading: eToro offers zero-commission stock trading on real stocks, making it an attractive option for long-term investors.

Virtual Portfolio: eToro provides a free demo account with $100,000 in virtual funds, allowing beginners to practice trading without risking real money.

Education and Support

Educational Resources: eToro offers the eToro Academy, which includes a wide range of educational content such as courses, webinars, videos, articles, and podcasts covering topics from beginner basics to advanced trading strategies.

Customer Support: eToro provides customer support via a ticketing system, live chat, and a comprehensive help center. Support availability may vary depending on the user’s account level.

Trading Terms

Spreads and Commissions: eToro offers competitive spreads on forex, crypto, and other CFD instruments. Real stock trades are commission-free. However, spreads on certain instruments may be wider compared to dedicated ECN brokers.

Deposit and Withdrawal Options: eToro supports multiple payment methods, including bank transfers, credit/debit cards, PayPal, Skrill, Neteller, and others. Deposits are typically processed quickly, though bank transfers may take longer.

Minimum Deposit: The minimum deposit on eToro varies by region, typically starting from $50 to $200 depending on the user’s country of residence.

Withdrawal Fee: eToro charges a flat withdrawal fee of $5, which is a consideration for traders who withdraw funds frequently.

Risk Management

Stop-Loss Orders: eToro provides standard risk management tools, including stop-loss and take-profit orders, to help traders manage their positions.

Negative Balance Protection: eToro offers negative balance protection for CFD trading, ensuring that clients cannot lose more than their account balance.

Pros

- Innovative CopyTrading: eToro’s CopyTrading feature is industry-leading, allowing beginners to benefit from the expertise of successful traders.

- Commission-Free Stocks: Zero-commission stock trading on real shares is a major advantage for investors.

- Extensive Crypto Selection: One of the widest cryptocurrency offerings among regulated mainstream brokers.

- Strong Regulation: Regulated by top-tier authorities including the FCA, CySEC, ASIC, and SEC.

- User-Friendly Platform: The social media-inspired interface makes trading accessible and engaging for all levels.

Cons

- Withdrawal Fee: The $5 flat withdrawal fee may be a disadvantage for traders who withdraw frequently.

- Wider Spreads: Compared to ECN brokers, eToro’s spreads on some instruments can be relatively wide.

- No MetaTrader Support: eToro does not support MetaTrader platforms, which may deter traders who prefer MT4 or MT5.

- Inactivity Fee: eToro charges a $10 monthly inactivity fee after 12 months of no login activity.

Conclusion

eToro is a trailblazer in the online trading industry, offering a unique combination of social trading, CopyTrading, and commission-free stock investing. Its user-friendly platform and extensive range of assets make it an excellent choice for both beginners and experienced investors. However, traders should be mindful of the withdrawal fees, inactivity charges, and wider spreads on certain instruments. As always, it is important to understand the risks associated with trading and to invest responsibly.

Comments